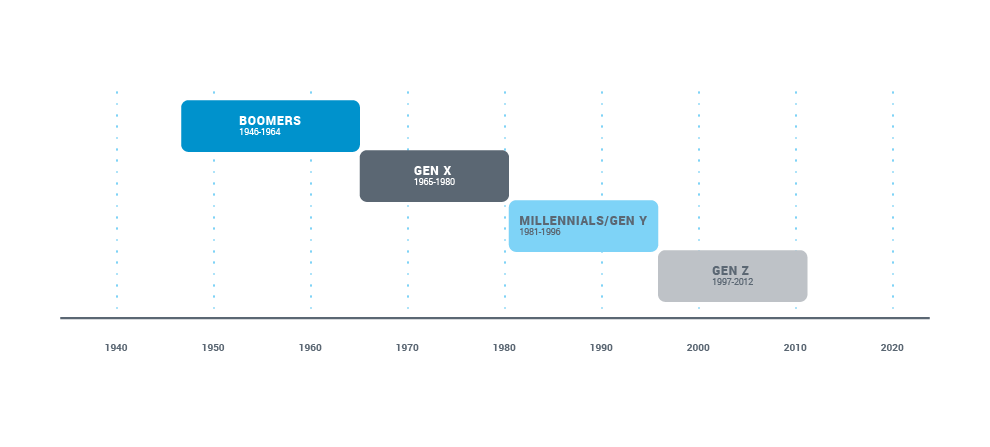

Financial services marketing has often focused on the silent generation (born 1925-1945) through baby boomers, seeing them as potential investors with the most wealth. But Gen X, Gen Y (millennials), and even Gen Z are heavily investing and planning their long-term financial futures.

The market uncertainty of 2020 brought an influx of new investors into the U.S. stock market, hoping to capitalize on the opportunities presented by market volatility.

With a median age of 35, these new investors represent 15% of those currently invested in the U.S. stock market. Prior to this 2020 influx of new investors, the median age of investors was 48.

Not all investors are the same.

We recently shared how a buyer’s journey can help financial advisors focus attention and messaging on the right buyers/investors at the right time.

When segmenting your target audience by age, you start to see some trends emerge, not only in the best way to reach them, but also what financial topics they are most interested in.

The following are some interesting trends we are seeing in the market for baby boomers, Gen X, millennials, and older Gen Z.

Baby boomers: The risk takers

Typically, financial professionals recommend investors move their funds into less risky allocations as they approach retirement. Yet many baby boomers, up to 8 percent, are completely invested in stocks.

In fact, almost 50% of baby boomer investors choose riskier investments than a financial advisor would recommend. Most work with a trusted advisor and are not looking to move their money to someone new.

Gen X: The straight shooters

This group is more likely to talk to a financial professional about their investments. But don’t jump to the conclusion that they are seeking the same one-on-one interaction as their parents and grandparents; they are looking for a qualified financial expert who can help set the course for fulfilling their personal goals.

A recent study conducted by T. Rowe Price noted 60% of Gen X and millennials are looking for a “financial coach,” someone who helps motivate and provides steps to attain their financial goals.

The younger members of this generation are busy earning and saving, while also worrying about their kids’ college funds. The older members of this generation are perhaps starting to look toward early retirement.

Regardless of where they fall within their generation, Gen X investors expect financial advisors to provide fast and accurate information they can trust.

Millennials (Gen Y): The conscientious

This group is responsible for the drastic increase in socially focused investing. They actively seek out companies with a strong focus on environmental, social and governance (ESG) investments.

They tend to do their own research, check with peers, and make their own investment decisions. Because they largely focus on their own research, they are more likely to use forums and listen to trusted podcasts to round out their investment knowledge.

A BlackRock survey found that 45% of millennials are more interested in investing in the stock market today than they were just five years ago.

Millennials do reach out to financial advisors for investment information but are far less likely to pick up the phone and instead will use apps and websites to supplement their financial knowledge.

Gen Z: The digitally savvy

The oldest members of this generation are young professionals who are stepping into their first investment experiences. They are setting up 401(k)s as part of their new-found independent status.

Of all the generations we’ve explored, Gen Z is the least likely to reach out to a financial advisor. Based on a study conducted by Broadridge Financial solutions, 39% of millennials currently work with a financial advisor with 65% planning to start in the next two years. Gen Z data indicates that only 23% are planning on working with a financial advisor. However, they are the most likely to seek and trust information found on traditional investment websites and opinions from friends and family.

Though they don’t have the investment weight of their older counterparts, this generation is at the beginning of their investment lifespan and shouldn’t be ignored by financial institutions.

Gen Z investors aren’t sitting around waiting for things to happen. According to a 2021 21st Annual Transamerica Retirement Survey, 70% of Gen Z investors are already starting to save for retirement, which means their median investment age is only 19!

Millennials, on the other hand, didn’t start saving for retirement until 25 (still fairly young, but each year can impact retirement dollars exponentially). Gen X and baby boomers didn’t start saving for retirement until 30 and 35 years old, respectively.

This information indicates a drive for Gen Z investors to actively pursue their financial futures with the goal of enjoying more retirement funds down the road.

How generational differences impact marketing

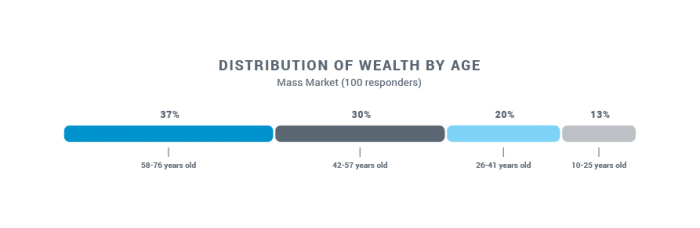

We are on the cusp of a monumental change. With $30 trillion set to change hands over the next few decades, this will be the largest intergenerational wealth transfer in history. This means marketing must change too.

Baby boomers have long been the focus of marketing efforts because they have the most wealth. But as they retire or near the end of their lives, that’s changing.

A recent Morgan Stanley survey finds that aging baby boomers are passing money down to their Gen X and millennial descendants. As a result, Gen X investors have seen their wealth jump since 2016 as they hit their prime earning years during a record bull market.

The older members of this generation have kids in college and are paying down mortgages while actively contributing to their retirement accounts. They want to work with financial experts who can provide them with relevant information to help achieve their goals.

Millennials and Gen Z are starting to increase their investment amounts and are exploring different investment topics to round out their financial knowledge. Now is the right time for financial advisors to connect with those groups.

A recent survey of 400+ financial advisors found that only 11% were actively targeting millennial investors as their primary audience. When millennials are considered the largest percentage of the population, not focusing on their investment needs results in a significant missed opportunity.

Embrace a multi-generational marketing strategy.

Based on the data uncovered, we strongly feel that now is the time to focus on Gen X, millennial, and Gen Z investors. The next question is how to reach these investors and what topics are of interest to them. We’ll do a deep dive into marketing to these investors in upcoming articles.