Millennials and Gen-Zers are considered the internet generations by many. Having grown up with easy access to technology, they rely on online resources to gain financial knowledge and obtain investment advice.

They also tend to be more idealistic and socially driven than other generations, which is reflected in their financial interests and investment choices.

As these generations inherit wealth from their parents and grandparents, they often migrate that wealth to a new financial advisor who is more in touch with their interests and communication style. This opens the door to becoming that advisor through outreach.

What we know about millennials + Gen-Zers

Millennials feel more confident about their investment opportunities than baby boomers.

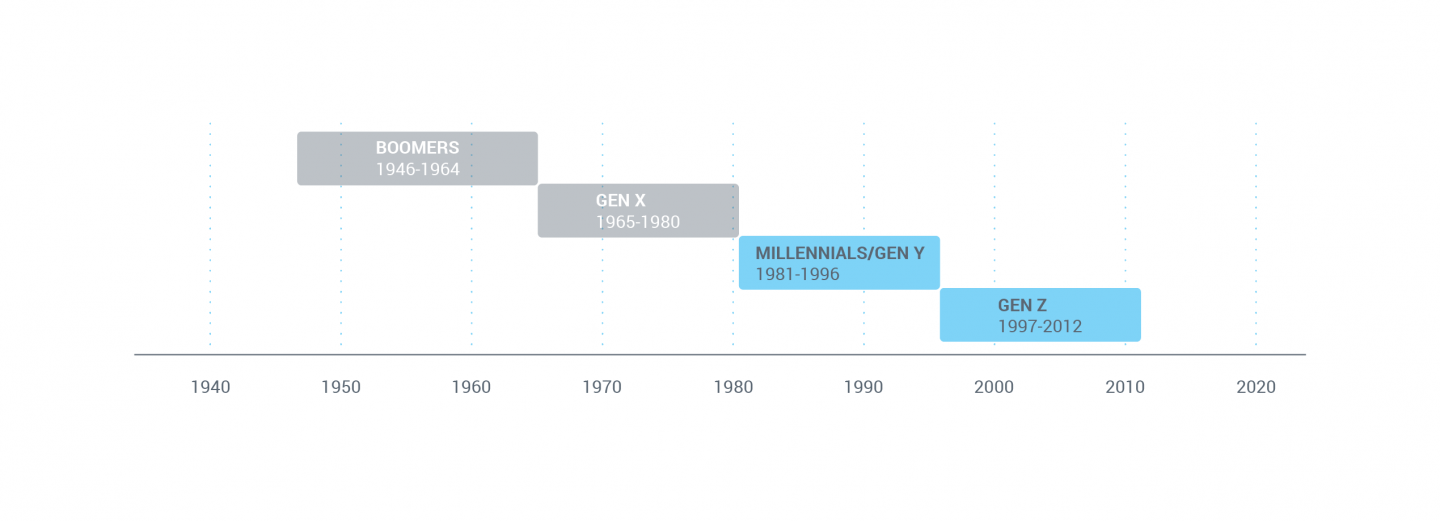

According to the U.S. Census Bureau, millennials have now surpassed baby boomers as our largest living adult generation.

However, as stated in our previous article, only 11% of financial advisors are actively targeting millennial investors.

Gen Z is already on track to become the largest generation of consumers with $360 billion in disposable income. This estimate more than doubled predictions from three years ago.

Members of Gen Z save a lot of their earnings—on average, about a third of their income, noted in a report from Gen Z Planet, a research and consulting firm.

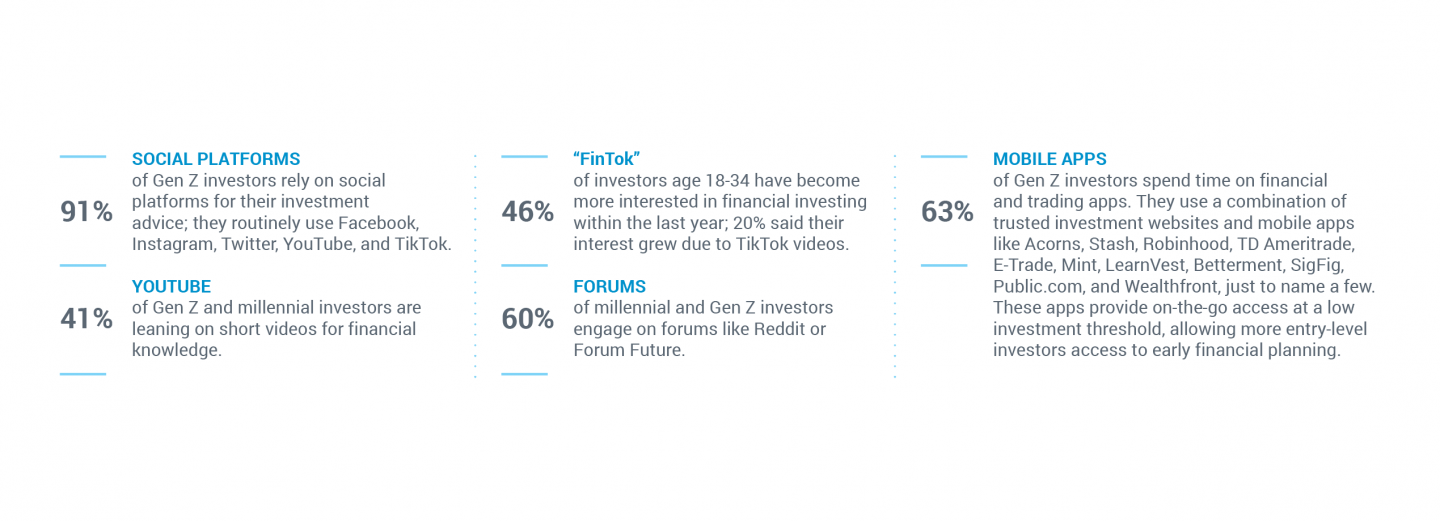

Millennials and Gen-Zers are increasing their investments and are exploring new investment topics to round out their financial knowledge. In fact, 29% of these investors seek financial advice from their friends, family and influencers. Additionally, 91% of Gen Z investors report getting investment information from social media within the last month.

Now is the time for financial advisors to connect with millennials and Gen-Zers.

Where WE market to millennials + gen z

Connecting with millennial and Gen Z investors isn’t the same as connecting with boomers and Gen-Xers. The younger generations aren’t as motivated to discuss their financial future on the golf course or over a lunch meeting.

These groups are driven by anything tech-related and drawn to using a myriad of high-tech and social media tools. These options allow them to apply their funds through the investment channels they prefer.

Sources:

What millennials + gen-zers expect from Financial Advisors

When millennial and Gen Z investors want financial recommendations or to purchase shares, they start with trusted online resources. They use these resources first, then reach out to advisors for financial advice. Additionally, these investors prefer to follow their investments online instead of waiting for mailed documents.

82% of Gen Z and millennial investors trust traditional investing websites more than almost all other sources of investing information.

To reach millennial and Gen Z investors, financial advisors need to appear in their digital environments. These investors expect financial advisors to connect with them on a regular basis with new ideas or topics that interest them—such as the following.

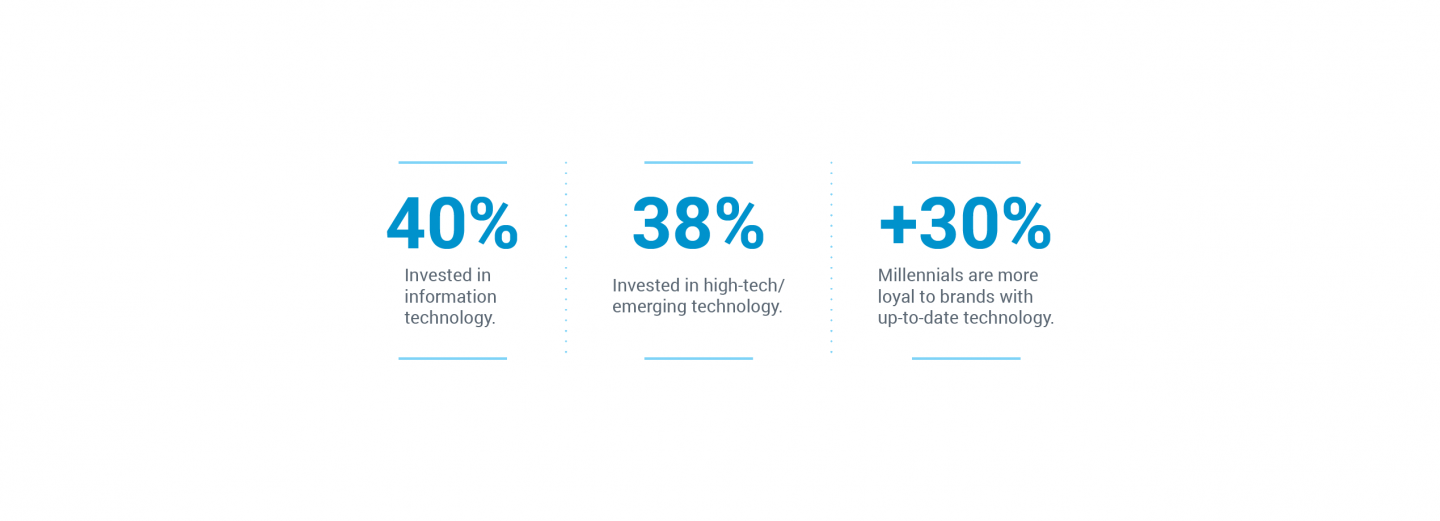

Innovation + technology

These two generations are tech savvy, having used technology throughout most of their lives. It makes sense that they would also embrace investing in technology.

Source: The Motley Fool

Forbes found that more than $1 billion was invested by millennials and Gen-Zers in tech-related, personal finance companies over the past few years.

Startups that target younger investors with mobile-enabled, user-friendly software and platforms are the companies seeing their business grow as a reward. Financial advisors will want to offer thought leadership and messaging about these topics to reach these investors.

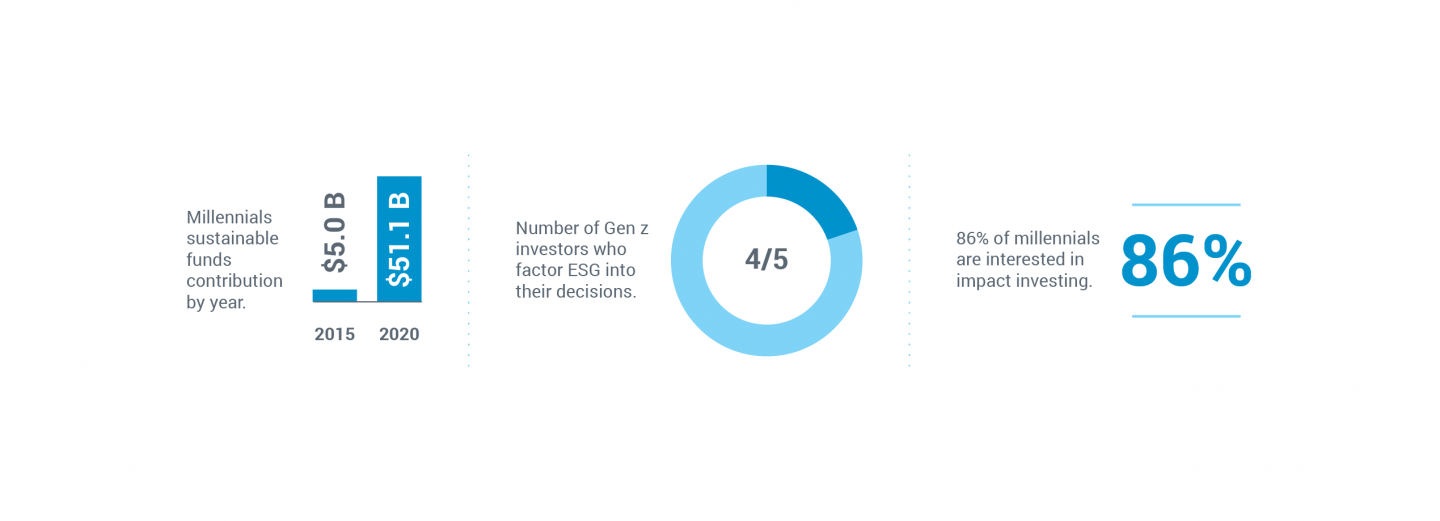

Environmental, social + governance (ESG)

Millennial and Gen Z investors are driven to focus their investments on ways that can affect global change. They are aware that climate change and global social issues will have a strong impact in their lifetimes, and they are hoping to be part of the solution.

Sources (from left to right): CNBC, BoFA Global Research (1 December 2020) Ok Zoomer: Gen Z Primer, Morgan Stanley

Financial advisors need to be ready to discuss ESG in depth. In fact, 89% of millennials expect their financial advisors to provide thorough research and information about ESG factors and history to guide recommendations for these investments.

To truly benefit from this important investment topic, financial marketers could look to implementing personalized marketing to reach potential ESG-focused investors.

Cryptocurrency

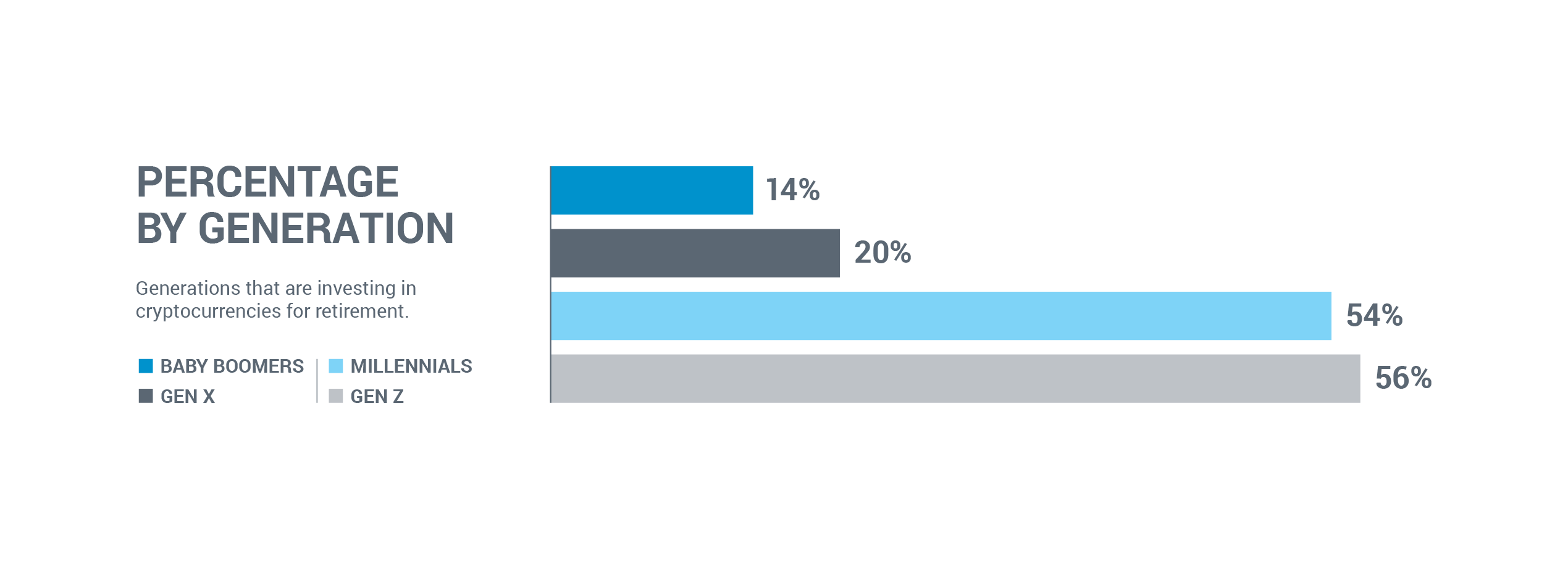

These generations have time to wait before they retire. As a result, they may be willing to take on more risk. This is where cryptocurrency comes in as a logical investment option. In fact, millennials and Gen-Zers are more likely to have crypto in their retirement portfolios than other generations.

With the crypto market cap topping $3 trillion, financial advisors need to be prepared to guide clients through these investment options.

More than 94% of people who own crypto were either millennials or members of Gen Z.

Source: Money.com

Cryptocurrency is not just a retirement savings option. These generations have great confidence in crypto, including it as part of their non-retirement savings accounts. In addition, findings from a recent survey show 36% of millennials—and 51% of Gen-Zers—would be comfortable with their employers paying them in digital currencies.

Financial advisors may benefit from providing cryptocurrency information on their websites and in articles, thought leadership, and guidance on financial forums. Providing this knowledge through various marketing channels will position advisors as the experts who millennials and Gen-Zers can rely on.

Invest your marketing budget in Millennial + Gen Z investors

Millennial and Gen Z investors will be in their peak earning and savings years for a long time, making them a good “investment” for financial advisors. Therefore, to build trust in the minds of millennial and Gen Z investors, financial advisors should focus on innovation and technology, ESG, and cryptocurrency investments. They will also want to be prepared to talk about these topics where the investors are most comfortable.