COVID-19 had an enormous impact in the past year, changing how we work, live, shop, and invest. Financial institutions pivoted to meet customers’ needs, offering remote access to information, financial advisors, and banking.

Online marketing has become a vital tool to engage with current and prospective customers. We saw an increase of nearly 17% in online advertising for financial firms and that trend is expected to continue[1].

With job shifts and uncertainty for many, concern about long-term investing became a focus for investors of all ages. In the year ahead, we expect to see investors continue to watch investments closely, while also focusing on a broad range of topics from inflation to cryptocurrency and ESG to fintech.

In 2022, financial clients will look to reliable sources of information to guide them through another year of uncertainty.

It’s important to note that individuals who actively consume financial advice are likely to invest more money than those who don’t, 62% versus 47%[2]. With financial experts predicting anything from a market correction to continued growth, they will turn to their trusted advisors while also watching for subject-matter experts online.

To succeed, financial firms should be seen as one of those experts to gain the trust of current and prospective clients. To do that in an ever-changing landscape, firms should consider these five must-haves.

1. An omnichannel approach

The concept of omnichannel marketing isn’t new, however, how we implement it and what we get out of it have evolved.

We all understand the age-old concept of reach and frequency. The goal was to make sure we reached our intended audience groups enough times to be remembered. This doesn’t necessarily take into account the various ways you can reach those targeted groups, which is why we need to consider an omnichannel marketing approach.

The concept of omnichannel focuses on implementing various marketing channels to deliver a consistent brand experience to our clients and prospects. The channels can be physical, such as in-person meetings, or digital, such as websites or social media, just to name a few.

Omnichannel marketing isn’t exclusive to any one industry; clients from manufacturing to healthcare and from retail to finance are all implementing these effective strategies.

What has made the implementation of omnichannel marketing a challenge for financial institutions is the fact that tracking the success of these efforts isn’t consistent.

In fact, a study conducted by Experian noted that 51% of financial companies rely on a simplistic or inaccurate format of marketing attributions — sometimes having no data-driven insight to determine what channels are delivering the largest number of conversions to get the highest ROI.[3]

Data is king; therefore, financial institutions need to develop a baseline of data to determine which marketing channels are most effective. These efforts inform future marketing decisions and ultimately help save budget on tactics that don’t yield strong enough results.

Multiple touchpoints

Successful omnichannel marketing approaches are customer-centric. By focusing on your target audiences, you can tailor how you communicate with them, where and when, and apply a level of personalization to your marketing efforts.

Those elements are critical since clients and prospects are used to obtaining information quickly, expect consistent encounters with your brand, and assume that this will all happen seamlessly across all communication platforms and devices.

Prospects typically have between six and eight touchpoints with your brand or content before reaching out.[4]

Touchpoints may be paid or non-paid, but we are quickly learning you can’t only focus on one type alone.

Leading data, insights, and consulting company Kantar Connect’s database (whose statistics are woven through many online articles within the marketing industry) reveals non-paid touchpoints are more important than paid.

Yes, 74% of the overall brand impact is thanks to non-paid touchpoints. As we take this idea a step further, we notice that human touchpoints remain extremely important, because professionals and our peers alike can help build trust and explain complex financial investments.[5]

Whether this results in interactions with an investment professional or testimonials and referrals from friends and family, these efforts all help contribute to 20% of that impact.

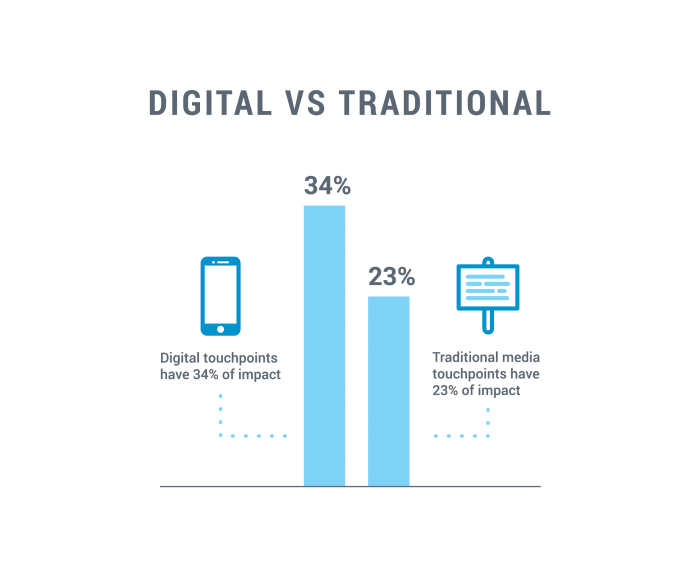

Digital + traditional touchpoints

Before you cross off your digital media budget completely, consider this: digital touchpoints are still considered strong drivers of brand and ultimately of sales, creating 34% of impact compared to 23% for traditional media touchpoints (TV, radio, and print, for example).[6]

We can determine with confidence that prospects and clients are more likely to remember your brand if they have regular interactions with your company through an omnichannel marketing approach.

2. Personalized communication

The financial services industry has historically focused on personal touch in serving clients. When it comes to advice in handling their money, clients want a one-on-one approach with face-to-face meetings to build trust.

But has that changed throughout the pandemic and as younger investors and advisors become part of the equation? The shifting work model of COVID-19 has shown us it has.

Throughout the COVID-19 pandemic, individuals became more accustomed to having business interactions online. That extended to financial advisors and their clients of all ages. Pre-pandemic face-to-face meetings dropped from 56% to 12% throughout the past year and video calls increased from 2% to 48%[6]. About a third of advisors expect that shift to be permanent.

As millennials enter their 40s, we see their search for financial advice increase, and they’re doing it online.[7]

A digital-first mindset combined with personalized human interaction will become the new normal. That sounds like a daunting challenge but there are ways to get there.

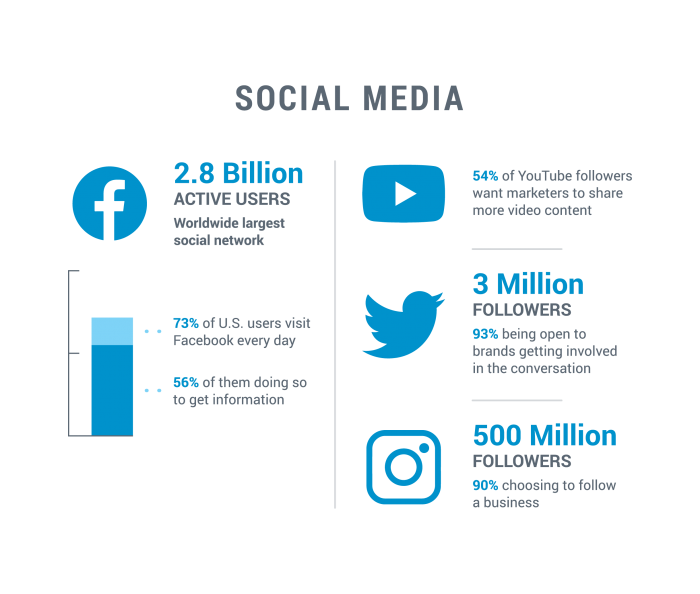

Many of you already use LinkedIn, Twitter, Facebook, or other favorites as a part of your interaction with business colleagues, family, and friends. Making social media work well for you is the first step.

LinkedIn’s 700 million-plus users, along with tools to target your messaging to a focused group of potential clients sharing business knowledge and ideas, make it a logical starting place for many financial firms. In 2021, 46% of all social media traffic to company websites came from LinkedIn.[8]

Looking at research results on social media usage in financial marketing, we see that 87% of financial institutions use Facebook, 52% use Twitter, and 47% use LinkedIn.[8]

While it’s sometimes difficult to measure the direct impact of social media, it’s an important part of a comprehensive marketing strategy. It helps build brand awareness, highlight differentiators, and position your organization as thought leaders.

3. Subject-matter expertise

As noted above, social media provides the ideal platform to share ideas and business knowledge with your associates and many industries at large. In a way, content can be seen as a proving ground for why your company is a better fit than other similar companies.

Creating content to share earmarks you as a subject-matter expert who is knowledgeable on specific topics. You aren’t necessarily showcasing yourself or promoting your brand, it’s far more subtle than that. The goal is to help fuel interest in your content and therefore in you.

Content could be as simple as an article, video, podcast, client testimonial, or social media post. With enough exposure to your content, prospects and clients will come to view you as an expert and look to you and your organization to solve their problems.

Were you surprised we listed client testimonials as a content type? Until recently, testimonials for financial companies were not allowed by the U.S. Securities and Exchange Commission. [9]

Client testimonials are powerful tools for communicating expertise and affirming capabilities. They provide an unbiased account of services that potential clients can relate to.

4. A buyer’s journey

You’re almost certainly familiar with the sales funnel—a tool used to plan outreach to the right sales targets. That tool from the past has evolved into something more in-depth—the buyer’s journey.

A buyer’s journey documents how your buyer moves through five stages: awareness, research, evaluation, activation, and maintenance. It details buyer needs, wants, pain points, and how your organization can address those.

Armed with this knowledge of your buyer and their journey, you can provide answers and value when they need it most. That in turn deepens relationships, helps manage issues, and successfully nurtures buyers toward activation.

A solid understanding of the buyer’s journey keeps your sales and marketing teams in alignment. Marketing will understand what buyers need to reach out to sales, and sales will understand how marketing’s efforts draw buyers in.

Gathering client and prospect data throughout the buyer’s journey allows us to track their behaviors and their interactions with emails, tailor messaging, and observe the effectiveness of this communication.

5. Data-driven insights

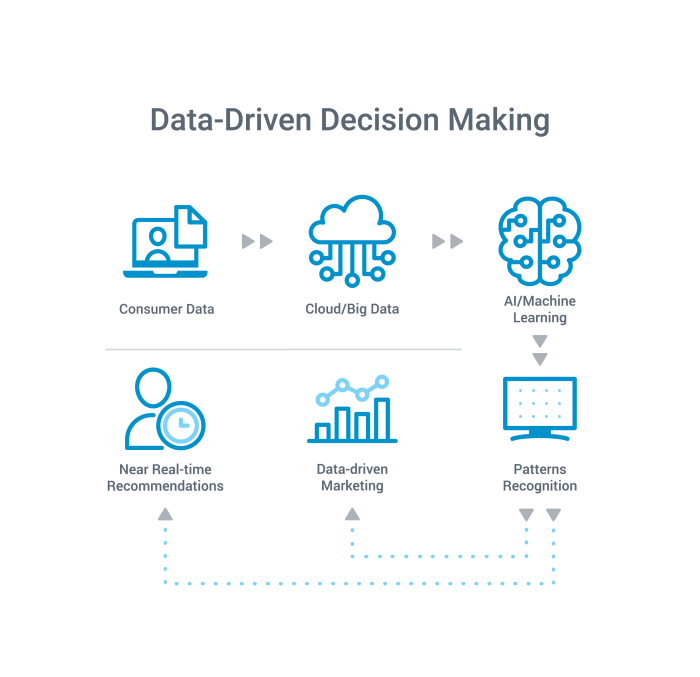

Data-driven decision-making is becoming an essential component of marketing practices across all business sectors.

Data integration allows marketers from financial firms to gauge how well a campaign or piece of content is performing. It allows you to track prospects on their buyer’s journey and to nurture current customers as well.

For your company’s data-driven strategy to succeed, it is essential to select key performance indicators (KPIs). These are the crucial data-driven analytics metrics that require your attention, efforts, and finances as a marketer.

The right mix of data automation and content creation across your marketing outreach gives your salespeople targeted prospects who are often ready to become customers. Tying sales data through to your CRM helps track the ROI of your marketing.

Adopting a “data-driven” marketing approach allows marketers to accurately identify customers across multiple devices. Not only does this save you time and resources, it also refines your customer’s experience and shows your audience you’re paying attention and recognizing their behaviors and needs.

To be successful in this new marketing environment ushered in by the pandemic, financial marketers must have an omnichannel approach, personalized communication, subject-matter expertise, a buyer’s journey, and data-driven insights.

All of these elements working together will help your organization generate leads, nurture audiences, and drive toward goals.