In the financial world, the SEC requires mutual funds to report holdings on a quarterly basis and has since passing the Investment Act of 1940. FINRA oversees securities firms doing business in the U.S. with regulations that govern the way firms market and sell mutual funds. Needless to say, the financial services industry is highly regulated and complex.

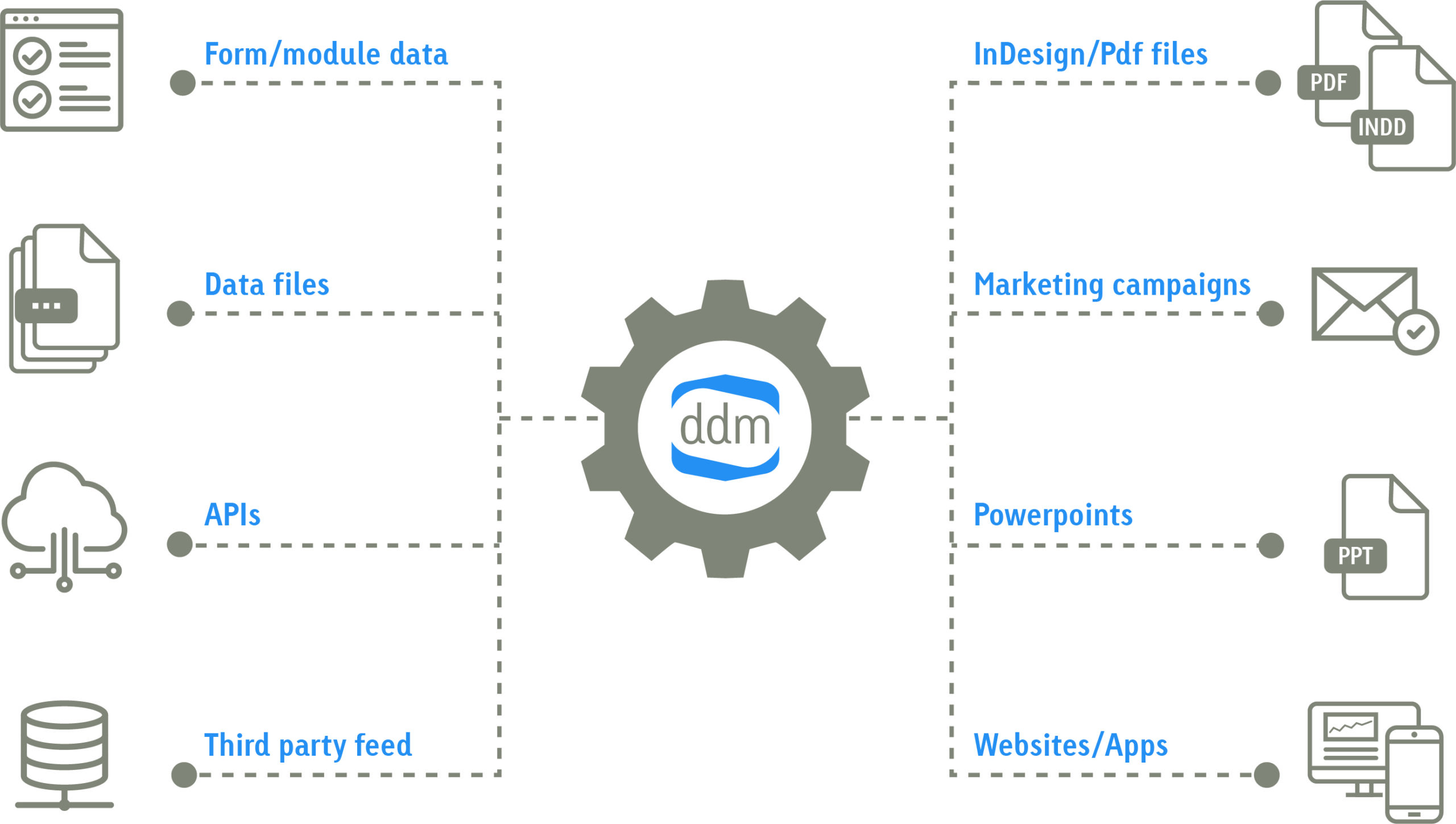

Since 2004, ddm has produced thousands of automated mutual fund fact sheets and quarterly reporting pieces, populating both InDesign and PowerPoint files via an xml feed. Our 13-person interactive group designed and built a robust automation platform using home-grown custom PHP code that was written in-house. With up to 60 funds with multiple share classes each, per client, per quarter, it was crucial that our automation system do some heavy lifting.

As a brief summary of what we do for our financial clients: we start with a blank proprietary platform, add funds, add share classes, add tickers and all content that is specific to each fund/class or shared groups of asset classes. We analyze the format of the data we receive to fill the slots. On the output end, we are equally comfortable designing new or using a client’s existing file to create tags that will receive the xml files produced by our system. We counsel clients on the types of data they use, how they use it, and even help with why they should or should not use certain types of content.

The Challenge

Mutual fund companies follow standard reporting procedures in process, what they report, and the timing of the reporting. Therefore, accuracy is paramount, and timing is everything. Although portfolio manager analysis is not required, many mutual fund companies choose to produce these commentaries as well, along with other marketing pieces their investors come to rely on. Before automation, data sources provided the numbers, portfolio managers crunched the numbers, and a designer painstakingly manually entered the content into a design file. The margin for human error was high with so many touchpoints. Mutual fund companies found that every quarter their reporting got bottlenecked. They realized they needed a marketing firm that knows the difference between a stock and a bond, and between a mutual fund and an exchange-traded fund. They needed a firm that had more experience than a local bank. They needed a firm that understood compliance.

The Solution

ddm’s financial services team has the expertise other marketers only claim to have. Armed with our knowledge, we refined our automation system to handle content of all kinds, whether from a third-party data provider or from our various clients. We can find and replace content known to have changed before it even gets through our system. We can create smart content pods that automatically shift a layout when other content is added. We can finetune output to any number of decimal points or number formats. We use a javascript library to dynamically create charts, complete with color coding and display labels, that flow into a design as quickly as the data and text does. In addition, our automation is flexible—supplying the same content to fact sheets, websites, emails, and apps—because we know the importance of accurate and consistent information.

The Result

What was once a lengthy process of several days to even weeks for some mutual fund companies to create mandated reporting is now reduced to hours. From receipt of data to fact sheets in a client’s hands can be as few as 24 hours. Our clients look to us for accurate and timely materials, quarter after quarter, year after year. In fact, we pride ourselves on our long-lasting client relationships. Our dedicated team gets to know their funds, their data, and their people. Because, after all, people still matter.

While our automation system was built for financial clients, we quickly realized what it could mean for other industries. A manufacturing client used it to automatically—and confidentially— insert highly sensitive, personal information into human resources reports that were mailed out to their employees. If a task is repeated over and over, chances are it can be automated, freeing internal teams from mundane tasks to focus on their unique strengths. Tell us what you do. We’re here to help.