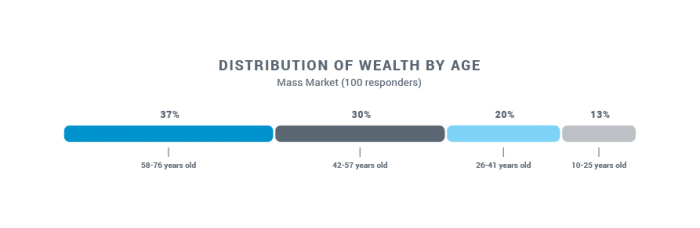

They’re called the sandwich generation, the forgotten generation, or simply Gen X. No matter how you slice it, in the end, they’re the ones smushed between older baby boomers and younger millennials. And yet, they’re poised to lead the way in terms of accumulating wealth.

Deloitte predicts Gen Xers will experience the highest increase in their share of national wealth through 2030. They’re expected to scoop up 32% of market share as they mature.

With about two decades of peak earnings ahead of them, they hope to make the most of those earnings.

With such a significant and evolving impact on the financial industry, marketers must learn how to communicate with and reach this lucrative audience.

It begins with a clear understanding of who they are and their needs.

What we know about Gen X

Gen X is 65 million strong with a typical net worth of $168,600. Their day-to-day life is filled with prioritizing and juggling multiple responsibilities.

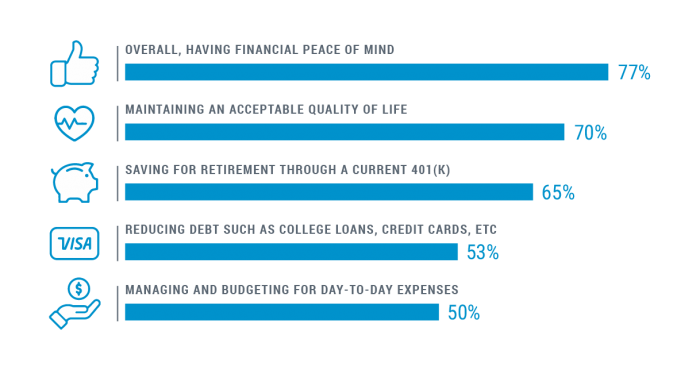

They’re caring for aging parents while saving for their children’s college education. They’re also paying down credit card debt, student loans, and mortgages.

Even though many Gen Xers have 75% more income than their parents did at the same age, they’re sensitive to how market volatility impacts their nest egg.

Forty-three percent of Gen Xers are behind on saving and 37% are convinced they cannot afford to retire.

Living through the tragedy of 9/11 and the financial crisis in 2008 has left them risk averse and leery of making investment mistakes. Layer on the growing concern that their retirement funds will disappear has left Gen X investors feeling anxious.

They’re looking to investment advisors for reassurance and stability to counter that anxiety.

Among Gen Xers’ top goals are owning a home, paying off debt, and saving for retirement. While many started their retirement savings at 30, they’re now feeling pressure to catch up before retirement, which is their primary reason for working with an advisor.

Gen Xers also want financial flexibility that gives them confidence in their retirement plans while still allowing room to enjoy their lives before retirement.

Messaging to Gen X

So, what does that all mean in terms of your marketing messages? It means those who speak to Gen X’s goals and concerns and offer solutions will win the day.

Fewer than half of Gen Xers currently use an advisor. This opens the door to having a financial expert step in and become a trusted resource, providing recommendations to diversify investments to help ease the peaks and valleys of financial risk.

Suggest strategies that help Gen X investors feel confident they can support a family in their current season of life as well as position themselves for retirement.

Provide Gen Xers with quick and accurate responses to their questions. A recent survey cites that 41% would consider changing their advisor if they weren’t getting prompt responses and proactive outreach with relevant ideas.

Make sure your marketing messages make them feel understood. Stress that you’re there as a partner who has their best interests and goals in mind.

Effective ways to reach Gen X

Gen X investors have strong preferences when it comes to communication channels.

- Gen Xers prefer email marketing.

- Over 80% of Gen Xers have a Facebook account.

- Many Gen Xers rely on YouTube for entertainment.

- They respond to traditional advertising like radio, television, and print but also digital banner ads.

Leverage an omnichannel marketing approach that incorporates these channels. Then, pair them with a strong web presence that includes educational videos, white papers, and access to relevant information.

Keep in mind, Gen Xers strongly value direct communication. Don’t let too much time pass before you follow up with a call or email. In the long run, that readily available direct communication is what builds trust with this group.

Gen X may be the forgotten generation to everyone else, but they shouldn’t be forgotten by you. By taking the time to understand their goals and needs, you can help them feel confident in their future.