Investments in content marketing result in portfolios rich with a wealth of valuable assets. See what we did there? That about covers all of the relevant financial puns in one sentence.

With that out of the way, let’s address the gigantic elephant in the room. Yes, you CAN invest in content marketing despite all of the financial regulations, guidelines and laws. Don’t let compliance fears prevent you from creating compelling content like videos, blog articles, testimonials and podcasts.

Financial institutions CAN develop content

Financial institutions like consumer banks, institutional finance companies and wealth management firms have traditionally built a loyal following based on referrals or proximity to the customer. Referrals, whether from family, friends or acquaintances, are the gold standard when it comes to customer acquisition. As long as you have a consistent stream of them, you’re set.

But millennials and Gen Xers are operating differently from generations past. To acquire them takes a bit more work. According to Contently’s Financial Services Content Report, “The collective wealth of millennials and Gen Xers is expected to triple by 2030 such that they will represent plurality of share of 100% wealth (47%) by 2030. Wealth management brands face a narrowing window of opportunity to adapt their conventional 4% customer acquisition strategy to this young, newly profitable group.”

These groups aren’t as easily swayed by the path past generations and older family members have taken. They’re looking to forge paths and build relationships of their own based on research they, themselves, conduct. If you don’t have content ready to go when they begin researching your company, they’re going to your competitor who does.

Learn more about ddm’s financial services expertise.

Do people actually read or pay attention to financial content?

The answer is a resounding YES!

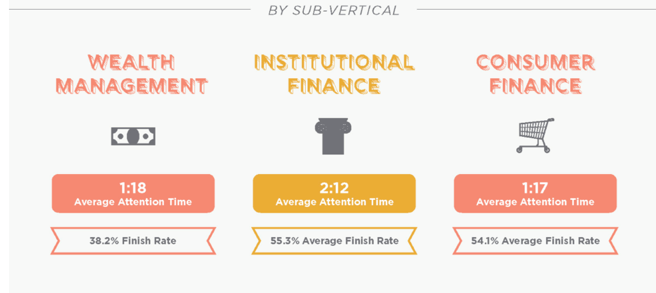

Contently’s report revealed the average time people spend on financial services content is 17% higher than all other industries. People spend an average of 1:18 minutes on wealth management content, 2:12 minutes on institutional finance content and 1:17 minutes on consumer finance content. The study finds the most effective buyer enablement content follows this structure: identify a key challenge, educate consumers and offer a clear solution.

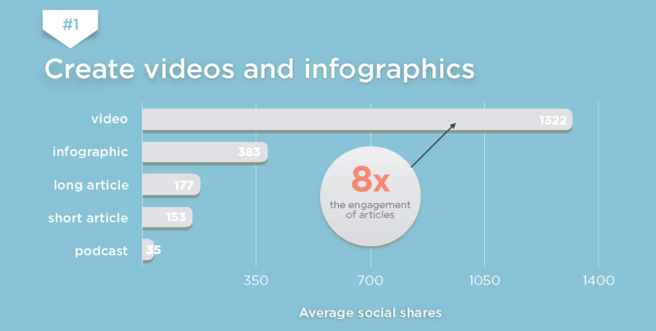

The study also detailed what types of content perform best for financial institutions.

“Our industry analysis found that videos and infographics outclassed other content formats in terms of average social shares. In fact, video drove eight times as many shares as articles.” – Contently Financial Services Content Report

ddm’s content recommendations are informed by targeted buyer journeys.

Compliance and regulations

For many financial services marketers, the conversation stops there. It’s not that they don’t understand why they need content. They probably even know what types of content they’re capable of producing. What they struggle with is how to put a consistent plan into place when there are so many hurdles to content approval.

This is where it pays to partner with a firm that specializes in complex and regulated industries. That’s what ddm does best. Not because we challenge rules, but because we understand them, and we know how to work within them. The tips below outline suggested steps for engaging compliance in the content creation process.

Financial services content that converts

What’s left in the content marketing puzzle is understanding the connection between the content you create and key business metrics, and how that content then gets distributed. The Gartner L2 insight report for Wealth Management U.S.: Content Marketing found only 46% of brands’ content hubs include a path for conversion. Whether you’re distributing your organization’s content through a website, social media, email or a newsletter, make sure your audience has a clear next step or call to action. Encourage them to call, email, set up a meeting or download an asset. You’ll know the value of that piece of content when the phone rings, someone inputs their information or engages with you, or they sign up for your newsletter.

If we’ve convinced you that, as a financial institution, you CAN embrace content marketing as a way to reach that next wealth generation and engage current clients, call us. We’ll help strategize a protocol and process for managing risk and compliance, optimize distribution channels, and brainstorm and craft content that engages and informs.